11 Time Series

Time series data is an important form of structured data in many different fields, such as finance, economics, ecology, neuroscience, and physics. Anything that is recorded repeatedly at many points in time forms a time series. Many time series are fixed frequency, which is to say that data points occur at regular intervals according to some rule, such as every 15 seconds, every 5 minutes, or once per month. Time series can also be irregular without a fixed unit of time or offset between units. How you mark and refer to time series data depends on the application, and you may have one of the following:

- Timestamps

-

Specific instants in time.

- Fixed periods

-

Such as the whole month of January 2017, or the whole year 2020.

- Intervals of time

-

Indicated by a start and end timestamp. Periods can be thought of as special cases of intervals.

- Experiment or elapsed time

-

Each timestamp is a measure of time relative to a particular start time (e.g., the diameter of a cookie baking each second since being placed in the oven), starting from 0.

In this chapter, I am mainly concerned with time series in the first three categories, though many of the techniques can be applied to experimental time series where the index may be an integer or floating-point number indicating elapsed time from the start of the experiment. The simplest kind of time series is indexed by timestamp.

pandas also supports indexes based on timedeltas, which can be a useful way of representing experiment or elapsed time. We do not explore timedelta indexes in this book, but you can learn more in the pandas documentation.

pandas provides many built-in time series tools and algorithms. You can efficiently work with large time series, and slice and dice, aggregate, and resample irregular- and fixed-frequency time series. Some of these tools are useful for financial and economics applications, but you could certainly use them to analyze server log data, too.

As with the rest of the chapters, we start by importing NumPy and pandas:

In [12]: import numpy as np

In [13]: import pandas as pd11.1 Date and Time Data Types and Tools

The Python standard library includes data types for date and time data, as well as calendar-related functionality. The datetime, time, and calendar modules are the main places to start. The datetime.datetime type, or simply datetime, is widely used:

In [14]: from datetime import datetime

In [15]: now = datetime.now()

In [16]: now

Out[16]: datetime.datetime(2023, 4, 12, 13, 9, 16, 484533)

In [17]: now.year, now.month, now.day

Out[17]: (2023, 4, 12)datetime stores both the date and time down to the microsecond. datetime.timedelta, or simply timedelta, represents the temporal difference between two datetime objects:

In [18]: delta = datetime(2011, 1, 7) - datetime(2008, 6, 24, 8, 15)

In [19]: delta

Out[19]: datetime.timedelta(days=926, seconds=56700)

In [20]: delta.days

Out[20]: 926

In [21]: delta.seconds

Out[21]: 56700You can add (or subtract) a timedelta or multiple thereof to a datetime object to yield a new shifted object:

In [22]: from datetime import timedelta

In [23]: start = datetime(2011, 1, 7)

In [24]: start + timedelta(12)

Out[24]: datetime.datetime(2011, 1, 19, 0, 0)

In [25]: start - 2 * timedelta(12)

Out[25]: datetime.datetime(2010, 12, 14, 0, 0)Table 11.1 summarizes the data types in the datetime module. While this chapter is mainly concerned with the data types in pandas and higher-level time series manipulation, you may encounter the datetime-based types in many other places in Python in the wild.

| Type | Description |

|---|---|

date |

Store calendar date (year, month, day) using the Gregorian calendar |

time |

Store time of day as hours, minutes, seconds, and microseconds |

datetime |

Store both date and time |

timedelta |

The difference between two datetime values (as days, seconds, and microseconds) |

tzinfo |

Base type for storing time zone information |

Converting Between String and Datetime

You can format datetime objects and pandas Timestamp objects, which I’ll introduce later, as strings using str or the strftime method, passing a format specification:

In [26]: stamp = datetime(2011, 1, 3)

In [27]: str(stamp)

Out[27]: '2011-01-03 00:00:00'

In [28]: stamp.strftime("%Y-%m-%d")

Out[28]: '2011-01-03'See Table 11.2 for a complete list of the format codes.

| Type | Description |

|---|---|

%Y |

Four-digit year |

%y |

Two-digit year |

%m |

Two-digit month [01, 12] |

%d |

Two-digit day [01, 31] |

%H |

Hour (24-hour clock) [00, 23] |

%I |

Hour (12-hour clock) [01, 12] |

%M |

Two-digit minute [00, 59] |

%S |

Second [00, 61] (seconds 60, 61 account for leap seconds) |

%f |

Microsecond as an integer, zero-padded (from 000000 to 999999) |

%j |

Day of the year as a zero-padded integer (from 001 to 336) |

%w |

Weekday as an integer [0 (Sunday), 6] |

%u |

Weekday as an integer starting from 1, where 1 is Monday. |

%U |

Week number of the year [00, 53]; Sunday is considered the first day of the week, and days before the first Sunday of the year are “week 0” |

%W |

Week number of the year [00, 53]; Monday is considered the first day of the week, and days before the first Monday of the year are “week 0” |

%z |

UTC time zone offset as +HHMM or -HHMM; empty if time zone naive |

%Z |

Time zone name as a string, or empty string if no time zone |

%F |

Shortcut for %Y-%m-%d (e.g., 2012-4-18) |

%D |

Shortcut for %m/%d/%y (e.g., 04/18/12) |

You can use many of the same format codes to convert strings to dates using datetime.strptime (but some codes, like %F, cannot be used):

In [29]: value = "2011-01-03"

In [30]: datetime.strptime(value, "%Y-%m-%d")

Out[30]: datetime.datetime(2011, 1, 3, 0, 0)

In [31]: datestrs = ["7/6/2011", "8/6/2011"]

In [32]: [datetime.strptime(x, "%m/%d/%Y") for x in datestrs]

Out[32]:

[datetime.datetime(2011, 7, 6, 0, 0),

datetime.datetime(2011, 8, 6, 0, 0)]datetime.strptime is one way to parse a date with a known format.

pandas is generally oriented toward working with arrays of dates, whether used as an axis index or a column in a DataFrame. The pandas.to_datetime method parses many different kinds of date representations. Standard date formats like ISO 8601 can be parsed quickly:

In [33]: datestrs = ["2011-07-06 12:00:00", "2011-08-06 00:00:00"]

In [34]: pd.to_datetime(datestrs)

Out[34]: DatetimeIndex(['2011-07-06 12:00:00', '2011-08-06 00:00:00'], dtype='dat

etime64[ns]', freq=None)It also handles values that should be considered missing (None, empty string, etc.):

In [35]: idx = pd.to_datetime(datestrs + [None])

In [36]: idx

Out[36]: DatetimeIndex(['2011-07-06 12:00:00', '2011-08-06 00:00:00', 'NaT'], dty

pe='datetime64[ns]', freq=None)

In [37]: idx[2]

Out[37]: NaT

In [38]: pd.isna(idx)

Out[38]: array([False, False, True])NaT (Not a Time) is pandas’s null value for timestamp data.

dateutil.parser is a useful but imperfect tool. Notably, it will recognize some strings as dates that you might prefer that it didn’t; for example, "42" will be parsed as the year 2042 with today’s calendar date.

datetime objects also have a number of locale-specific formatting options for systems in other countries or languages. For example, the abbreviated month names will be different on German or French systems compared with English systems. See Table 11.3 for a listing.

| Type | Description |

|---|---|

%a |

Abbreviated weekday name |

%A |

Full weekday name |

%b |

Abbreviated month name |

%B |

Full month name |

%c |

Full date and time (e.g., ‘Tue 01 May 2012 04:20:57 PM’) |

%p |

Locale equivalent of AM or PM |

%x |

Locale-appropriate formatted date (e.g., in the United States, May 1, 2012 yields ‘05/01/2012’) |

%X |

Locale-appropriate time (e.g., ‘04:24:12 PM’) |

11.2 Time Series Basics

A basic kind of time series object in pandas is a Series indexed by timestamps, which is often represented outside of pandas as Python strings or datetime objects:

In [39]: dates = [datetime(2011, 1, 2), datetime(2011, 1, 5),

....: datetime(2011, 1, 7), datetime(2011, 1, 8),

....: datetime(2011, 1, 10), datetime(2011, 1, 12)]

In [40]: ts = pd.Series(np.random.standard_normal(6), index=dates)

In [41]: ts

Out[41]:

2011-01-02 -0.204708

2011-01-05 0.478943

2011-01-07 -0.519439

2011-01-08 -0.555730

2011-01-10 1.965781

2011-01-12 1.393406

dtype: float64Under the hood, these datetime objects have been put in a DatetimeIndex:

In [42]: ts.index

Out[42]:

DatetimeIndex(['2011-01-02', '2011-01-05', '2011-01-07', '2011-01-08',

'2011-01-10', '2011-01-12'],

dtype='datetime64[ns]', freq=None)Like other Series, arithmetic operations between differently indexed time series automatically align on the dates:

In [43]: ts + ts[::2]

Out[43]:

2011-01-02 -0.409415

2011-01-05 NaN

2011-01-07 -1.038877

2011-01-08 NaN

2011-01-10 3.931561

2011-01-12 NaN

dtype: float64Recall that ts[::2] selects every second element in ts.

pandas stores timestamps using NumPy’s datetime64 data type at the nanosecond resolution:

In [44]: ts.index.dtype

Out[44]: dtype('<M8[ns]')Scalar values from a DatetimeIndex are pandas Timestamp objects:

In [45]: stamp = ts.index[0]

In [46]: stamp

Out[46]: Timestamp('2011-01-02 00:00:00')A pandas.Timestamp can be substituted most places where you would use a datetime object. The reverse is not true, however, because pandas.Timestamp can store nanosecond precision data, while datetime stores only up to microseconds. Additionally, pandas.Timestamp can store frequency information (if any) and understands how to do time zone conversions and other kinds of manipulations. More on both of these things later in Time Zone Handling.

Indexing, Selection, Subsetting

Time series behaves like any other Series when you are indexing and selecting data based on the label:

In [47]: stamp = ts.index[2]

In [48]: ts[stamp]

Out[48]: -0.5194387150567381As a convenience, you can also pass a string that is interpretable as a date:

In [49]: ts["2011-01-10"]

Out[49]: 1.9657805725027142For longer time series, a year or only a year and month can be passed to easily select slices of data (pandas.date_range is discussed in more detail in Generating Date Ranges):

In [50]: longer_ts = pd.Series(np.random.standard_normal(1000),

....: index=pd.date_range("2000-01-01", periods=1000))

In [51]: longer_ts

Out[51]:

2000-01-01 0.092908

2000-01-02 0.281746

2000-01-03 0.769023

2000-01-04 1.246435

2000-01-05 1.007189

...

2002-09-22 0.930944

2002-09-23 -0.811676

2002-09-24 -1.830156

2002-09-25 -0.138730

2002-09-26 0.334088

Freq: D, Length: 1000, dtype: float64

In [52]: longer_ts["2001"]

Out[52]:

2001-01-01 1.599534

2001-01-02 0.474071

2001-01-03 0.151326

2001-01-04 -0.542173

2001-01-05 -0.475496

...

2001-12-27 0.057874

2001-12-28 -0.433739

2001-12-29 0.092698

2001-12-30 -1.397820

2001-12-31 1.457823

Freq: D, Length: 365, dtype: float64Here, the string "2001" is interpreted as a year and selects that time period. This also works if you specify the month:

In [53]: longer_ts["2001-05"]

Out[53]:

2001-05-01 -0.622547

2001-05-02 0.936289

2001-05-03 0.750018

2001-05-04 -0.056715

2001-05-05 2.300675

...

2001-05-27 0.235477

2001-05-28 0.111835

2001-05-29 -1.251504

2001-05-30 -2.949343

2001-05-31 0.634634

Freq: D, Length: 31, dtype: float64Slicing with datetime objects works as well:

In [54]: ts[datetime(2011, 1, 7):]

Out[54]:

2011-01-07 -0.519439

2011-01-08 -0.555730

2011-01-10 1.965781

2011-01-12 1.393406

dtype: float64

In [55]: ts[datetime(2011, 1, 7):datetime(2011, 1, 10)]

Out[55]:

2011-01-07 -0.519439

2011-01-08 -0.555730

2011-01-10 1.965781

dtype: float64Because most time series data is ordered chronologically, you can slice with timestamps not contained in a time series to perform a range query:

In [56]: ts

Out[56]:

2011-01-02 -0.204708

2011-01-05 0.478943

2011-01-07 -0.519439

2011-01-08 -0.555730

2011-01-10 1.965781

2011-01-12 1.393406

dtype: float64

In [57]: ts["2011-01-06":"2011-01-11"]

Out[57]:

2011-01-07 -0.519439

2011-01-08 -0.555730

2011-01-10 1.965781

dtype: float64As before, you can pass a string date, datetime, or timestamp. Remember that slicing in this manner produces views on the source time series, like slicing NumPy arrays. This means that no data is copied, and modifications on the slice will be reflected in the original data.

There is an equivalent instance method, truncate, that slices a Series between two dates:

In [58]: ts.truncate(after="2011-01-09")

Out[58]:

2011-01-02 -0.204708

2011-01-05 0.478943

2011-01-07 -0.519439

2011-01-08 -0.555730

dtype: float64All of this holds true for DataFrame as well, indexing on its rows:

In [59]: dates = pd.date_range("2000-01-01", periods=100, freq="W-WED")

In [60]: long_df = pd.DataFrame(np.random.standard_normal((100, 4)),

....: index=dates,

....: columns=["Colorado", "Texas",

....: "New York", "Ohio"])

In [61]: long_df.loc["2001-05"]

Out[61]:

Colorado Texas New York Ohio

2001-05-02 -0.006045 0.490094 -0.277186 -0.707213

2001-05-09 -0.560107 2.735527 0.927335 1.513906

2001-05-16 0.538600 1.273768 0.667876 -0.969206

2001-05-23 1.676091 -0.817649 0.050188 1.951312

2001-05-30 3.260383 0.963301 1.201206 -1.852001Time Series with Duplicate Indices

In some applications, there may be multiple data observations falling on a particular timestamp. Here is an example:

In [62]: dates = pd.DatetimeIndex(["2000-01-01", "2000-01-02", "2000-01-02",

....: "2000-01-02", "2000-01-03"])

In [63]: dup_ts = pd.Series(np.arange(5), index=dates)

In [64]: dup_ts

Out[64]:

2000-01-01 0

2000-01-02 1

2000-01-02 2

2000-01-02 3

2000-01-03 4

dtype: int64We can tell that the index is not unique by checking its is_unique property:

In [65]: dup_ts.index.is_unique

Out[65]: FalseIndexing into this time series will now either produce scalar values or slices, depending on whether a timestamp is duplicated:

In [66]: dup_ts["2000-01-03"] # not duplicated

Out[66]: 4

In [67]: dup_ts["2000-01-02"] # duplicated

Out[67]:

2000-01-02 1

2000-01-02 2

2000-01-02 3

dtype: int64Suppose you wanted to aggregate the data having nonunique timestamps. One way to do this is to use groupby and pass level=0 (the one and only level):

In [68]: grouped = dup_ts.groupby(level=0)

In [69]: grouped.mean()

Out[69]:

2000-01-01 0.0

2000-01-02 2.0

2000-01-03 4.0

dtype: float64

In [70]: grouped.count()

Out[70]:

2000-01-01 1

2000-01-02 3

2000-01-03 1

dtype: int6411.3 Date Ranges, Frequencies, and Shifting

Generic time series in pandas are assumed to be irregular; that is, they have no fixed frequency. For many applications this is sufficient. However, it’s often desirable to work relative to a fixed frequency, such as daily, monthly, or every 15 minutes, even if that means introducing missing values into a time series. Fortunately, pandas has a full suite of standard time series frequencies and tools for resampling (discussed in more detail later in Resampling and Frequency Conversion), inferring frequencies, and generating fixed-frequency date ranges. For example, you can convert the sample time series to fixed daily frequency by calling resample:

In [71]: ts

Out[71]:

2011-01-02 -0.204708

2011-01-05 0.478943

2011-01-07 -0.519439

2011-01-08 -0.555730

2011-01-10 1.965781

2011-01-12 1.393406

dtype: float64

In [72]: resampler = ts.resample("D")

In [73]: resampler

Out[73]: <pandas.core.resample.DatetimeIndexResampler object at 0x17b0e7bb0>The string "D" is interpreted as daily frequency.

Conversion between frequencies or resampling is a big enough topic to have its own section later (Resampling and Frequency Conversion). Here, I’ll show you how to use the base frequencies and multiples thereof.

Generating Date Ranges

While I used it previously without explanation, pandas.date_range is responsible for generating a DatetimeIndex with an indicated length according to a particular frequency:

In [74]: index = pd.date_range("2012-04-01", "2012-06-01")

In [75]: index

Out[75]:

DatetimeIndex(['2012-04-01', '2012-04-02', '2012-04-03', '2012-04-04',

'2012-04-05', '2012-04-06', '2012-04-07', '2012-04-08',

'2012-04-09', '2012-04-10', '2012-04-11', '2012-04-12',

'2012-04-13', '2012-04-14', '2012-04-15', '2012-04-16',

'2012-04-17', '2012-04-18', '2012-04-19', '2012-04-20',

'2012-04-21', '2012-04-22', '2012-04-23', '2012-04-24',

'2012-04-25', '2012-04-26', '2012-04-27', '2012-04-28',

'2012-04-29', '2012-04-30', '2012-05-01', '2012-05-02',

'2012-05-03', '2012-05-04', '2012-05-05', '2012-05-06',

'2012-05-07', '2012-05-08', '2012-05-09', '2012-05-10',

'2012-05-11', '2012-05-12', '2012-05-13', '2012-05-14',

'2012-05-15', '2012-05-16', '2012-05-17', '2012-05-18',

'2012-05-19', '2012-05-20', '2012-05-21', '2012-05-22',

'2012-05-23', '2012-05-24', '2012-05-25', '2012-05-26',

'2012-05-27', '2012-05-28', '2012-05-29', '2012-05-30',

'2012-05-31', '2012-06-01'],

dtype='datetime64[ns]', freq='D')By default, pandas.date_range generates daily timestamps. If you pass only a start or end date, you must pass a number of periods to generate:

In [76]: pd.date_range(start="2012-04-01", periods=20)

Out[76]:

DatetimeIndex(['2012-04-01', '2012-04-02', '2012-04-03', '2012-04-04',

'2012-04-05', '2012-04-06', '2012-04-07', '2012-04-08',

'2012-04-09', '2012-04-10', '2012-04-11', '2012-04-12',

'2012-04-13', '2012-04-14', '2012-04-15', '2012-04-16',

'2012-04-17', '2012-04-18', '2012-04-19', '2012-04-20'],

dtype='datetime64[ns]', freq='D')

In [77]: pd.date_range(end="2012-06-01", periods=20)

Out[77]:

DatetimeIndex(['2012-05-13', '2012-05-14', '2012-05-15', '2012-05-16',

'2012-05-17', '2012-05-18', '2012-05-19', '2012-05-20',

'2012-05-21', '2012-05-22', '2012-05-23', '2012-05-24',

'2012-05-25', '2012-05-26', '2012-05-27', '2012-05-28',

'2012-05-29', '2012-05-30', '2012-05-31', '2012-06-01'],

dtype='datetime64[ns]', freq='D')The start and end dates define strict boundaries for the generated date index. For example, if you wanted a date index containing the last business day of each month, you would pass the "BM" frequency (business end of month; see a more complete listing of frequencies in Table 11.4), and only dates falling on or inside the date interval will be included:

In [78]: pd.date_range("2000-01-01", "2000-12-01", freq="BM")

Out[78]:

DatetimeIndex(['2000-01-31', '2000-02-29', '2000-03-31', '2000-04-28',

'2000-05-31', '2000-06-30', '2000-07-31', '2000-08-31',

'2000-09-29', '2000-10-31', '2000-11-30'],

dtype='datetime64[ns]', freq='BM')| Alias | Offset type | Description |

|---|---|---|

D |

Day |

Calendar daily |

B |

BusinessDay |

Business daily |

H |

Hour |

Hourly |

T or min |

Minute |

Once a minute |

S |

Second |

Once a second |

L or ms |

Milli |

Millisecond (1/1,000 of 1 second) |

U |

Micro |

Microsecond (1/1,000,000 of 1 second) |

M |

MonthEnd |

Last calendar day of month |

BM |

BusinessMonthEnd |

Last business day (weekday) of month |

MS |

MonthBegin |

First calendar day of month |

BMS |

BusinessMonthBegin |

First weekday of month |

W-MON, W-TUE, ... |

Week |

Weekly on given day of week (MON, TUE, WED, THU, FRI, SAT, or SUN) |

WOM-1MON, WOM-2MON, ... |

WeekOfMonth |

Generate weekly dates in the first, second, third, or fourth week of the month (e.g., WOM-3FRI for the third Friday of each month) |

Q-JAN, Q-FEB, ... |

QuarterEnd |

Quarterly dates anchored on last calendar day of each month, for year ending in indicated month (JAN, FEB, MAR, APR, MAY, JUN, JUL, AUG, SEP, OCT, NOV, or DEC) |

BQ-JAN, BQ-FEB, ... |

BusinessQuarterEnd |

Quarterly dates anchored on last weekday day of each month, for year ending in indicated month |

QS-JAN, QS-FEB, ... |

QuarterBegin |

Quarterly dates anchored on first calendar day of each month, for year ending in indicated month |

BQS-JAN, BQS-FEB, ... |

BusinessQuarterBegin |

Quarterly dates anchored on first weekday day of each month, for year ending in indicated month |

A-JAN, A-FEB, ... |

YearEnd |

Annual dates anchored on last calendar day of given month (JAN, FEB, MAR, APR, MAY, JUN, JUL, AUG, SEP, OCT, NOV, or DEC) |

BA-JAN, BA-FEB, ... |

BusinessYearEnd |

Annual dates anchored on last weekday of given month |

AS-JAN, AS-FEB, ... |

YearBegin |

Annual dates anchored on first day of given month |

BAS-JAN, BAS-FEB, ... |

BusinessYearBegin |

Annual dates anchored on first weekday of given month |

pandas.date_range by default preserves the time (if any) of the start or end timestamp:

In [79]: pd.date_range("2012-05-02 12:56:31", periods=5)

Out[79]:

DatetimeIndex(['2012-05-02 12:56:31', '2012-05-03 12:56:31',

'2012-05-04 12:56:31', '2012-05-05 12:56:31',

'2012-05-06 12:56:31'],

dtype='datetime64[ns]', freq='D')Sometimes you will have start or end dates with time information but want to generate a set of timestamps normalized to midnight as a convention. To do this, there is a normalize option:

In [80]: pd.date_range("2012-05-02 12:56:31", periods=5, normalize=True)

Out[80]:

DatetimeIndex(['2012-05-02', '2012-05-03', '2012-05-04', '2012-05-05',

'2012-05-06'],

dtype='datetime64[ns]', freq='D')Frequencies and Date Offsets

Frequencies in pandas are composed of a base frequency and a multiplier. Base frequencies are typically referred to by a string alias, like "M" for monthly or "H" for hourly. For each base frequency, there is an object referred to as a date offset. For example, hourly frequency can be represented with the Hour class:

In [81]: from pandas.tseries.offsets import Hour, Minute

In [82]: hour = Hour()

In [83]: hour

Out[83]: <Hour>You can define a multiple of an offset by passing an integer:

In [84]: four_hours = Hour(4)

In [85]: four_hours

Out[85]: <4 * Hours>In most applications, you would never need to explicitly create one of these objects; instead you'd use a string alias like "H" or "4H". Putting an integer before the base frequency creates a multiple:

In [86]: pd.date_range("2000-01-01", "2000-01-03 23:59", freq="4H")

Out[86]:

DatetimeIndex(['2000-01-01 00:00:00', '2000-01-01 04:00:00',

'2000-01-01 08:00:00', '2000-01-01 12:00:00',

'2000-01-01 16:00:00', '2000-01-01 20:00:00',

'2000-01-02 00:00:00', '2000-01-02 04:00:00',

'2000-01-02 08:00:00', '2000-01-02 12:00:00',

'2000-01-02 16:00:00', '2000-01-02 20:00:00',

'2000-01-03 00:00:00', '2000-01-03 04:00:00',

'2000-01-03 08:00:00', '2000-01-03 12:00:00',

'2000-01-03 16:00:00', '2000-01-03 20:00:00'],

dtype='datetime64[ns]', freq='4H')Many offsets can be combined by addition:

In [87]: Hour(2) + Minute(30)

Out[87]: <150 * Minutes>Similarly, you can pass frequency strings, like "1h30min", that will effectively be parsed to the same expression:

In [88]: pd.date_range("2000-01-01", periods=10, freq="1h30min")

Out[88]:

DatetimeIndex(['2000-01-01 00:00:00', '2000-01-01 01:30:00',

'2000-01-01 03:00:00', '2000-01-01 04:30:00',

'2000-01-01 06:00:00', '2000-01-01 07:30:00',

'2000-01-01 09:00:00', '2000-01-01 10:30:00',

'2000-01-01 12:00:00', '2000-01-01 13:30:00'],

dtype='datetime64[ns]', freq='90T')Some frequencies describe points in time that are not evenly spaced. For example, "M" (calendar month end) and "BM" (last business/weekday of month) depend on the number of days in a month and, in the latter case, whether the month ends on a weekend or not. We refer to these as anchored offsets.

Refer to Table 11.4 for a listing of frequency codes and date offset classes available in pandas.

Users can define their own custom frequency classes to provide date logic not available in pandas, though the full details of that are outside the scope of this book.

Week of month dates

One useful frequency class is “week of month,” starting with WOM. This enables you to get dates like the third Friday of each month:

In [89]: monthly_dates = pd.date_range("2012-01-01", "2012-09-01", freq="WOM-3FRI

")

In [90]: list(monthly_dates)

Out[90]:

[Timestamp('2012-01-20 00:00:00'),

Timestamp('2012-02-17 00:00:00'),

Timestamp('2012-03-16 00:00:00'),

Timestamp('2012-04-20 00:00:00'),

Timestamp('2012-05-18 00:00:00'),

Timestamp('2012-06-15 00:00:00'),

Timestamp('2012-07-20 00:00:00'),

Timestamp('2012-08-17 00:00:00')]Shifting (Leading and Lagging) Data

Shifting refers to moving data backward and forward through time. Both Series and DataFrame have a shift method for doing naive shifts forward or backward, leaving the index unmodified:

In [91]: ts = pd.Series(np.random.standard_normal(4),

....: index=pd.date_range("2000-01-01", periods=4, freq="M"))

In [92]: ts

Out[92]:

2000-01-31 -0.066748

2000-02-29 0.838639

2000-03-31 -0.117388

2000-04-30 -0.517795

Freq: M, dtype: float64

In [93]: ts.shift(2)

Out[93]:

2000-01-31 NaN

2000-02-29 NaN

2000-03-31 -0.066748

2000-04-30 0.838639

Freq: M, dtype: float64

In [94]: ts.shift(-2)

Out[94]:

2000-01-31 -0.117388

2000-02-29 -0.517795

2000-03-31 NaN

2000-04-30 NaN

Freq: M, dtype: float64When we shift like this, missing data is introduced either at the start or the end of the time series.

A common use of shift is computing consecutive percent changes in a time series or multiple time series as DataFrame columns. This is expressed as:

ts / ts.shift(1) - 1Because naive shifts leave the index unmodified, some data is discarded. Thus if the frequency is known, it can be passed to shift to advance the timestamps instead of simply the data:

In [95]: ts.shift(2, freq="M")

Out[95]:

2000-03-31 -0.066748

2000-04-30 0.838639

2000-05-31 -0.117388

2000-06-30 -0.517795

Freq: M, dtype: float64Other frequencies can be passed, too, giving you some flexibility in how to lead and lag the data:

In [96]: ts.shift(3, freq="D")

Out[96]:

2000-02-03 -0.066748

2000-03-03 0.838639

2000-04-03 -0.117388

2000-05-03 -0.517795

dtype: float64

In [97]: ts.shift(1, freq="90T")

Out[97]:

2000-01-31 01:30:00 -0.066748

2000-02-29 01:30:00 0.838639

2000-03-31 01:30:00 -0.117388

2000-04-30 01:30:00 -0.517795

dtype: float64The T here stands for minutes. Note that the freq parameter here indicates the offset to apply to the timestamps, but it does not change the underlying frequency of the data, if any.

Shifting dates with offsets

The pandas date offsets can also be used with datetime or Timestamp objects:

In [98]: from pandas.tseries.offsets import Day, MonthEnd

In [99]: now = datetime(2011, 11, 17)

In [100]: now + 3 * Day()

Out[100]: Timestamp('2011-11-20 00:00:00')If you add an anchored offset like MonthEnd, the first increment will "roll forward" a date to the next date according to the frequency rule:

In [101]: now + MonthEnd()

Out[101]: Timestamp('2011-11-30 00:00:00')

In [102]: now + MonthEnd(2)

Out[102]: Timestamp('2011-12-31 00:00:00')Anchored offsets can explicitly “roll” dates forward or backward by simply using their rollforward and rollback methods, respectively:

In [103]: offset = MonthEnd()

In [104]: offset.rollforward(now)

Out[104]: Timestamp('2011-11-30 00:00:00')

In [105]: offset.rollback(now)

Out[105]: Timestamp('2011-10-31 00:00:00')A creative use of date offsets is to use these methods with groupby:

In [106]: ts = pd.Series(np.random.standard_normal(20),

.....: index=pd.date_range("2000-01-15", periods=20, freq="4D")

)

In [107]: ts

Out[107]:

2000-01-15 -0.116696

2000-01-19 2.389645

2000-01-23 -0.932454

2000-01-27 -0.229331

2000-01-31 -1.140330

2000-02-04 0.439920

2000-02-08 -0.823758

2000-02-12 -0.520930

2000-02-16 0.350282

2000-02-20 0.204395

2000-02-24 0.133445

2000-02-28 0.327905

2000-03-03 0.072153

2000-03-07 0.131678

2000-03-11 -1.297459

2000-03-15 0.997747

2000-03-19 0.870955

2000-03-23 -0.991253

2000-03-27 0.151699

2000-03-31 1.266151

Freq: 4D, dtype: float64

In [108]: ts.groupby(MonthEnd().rollforward).mean()

Out[108]:

2000-01-31 -0.005833

2000-02-29 0.015894

2000-03-31 0.150209

dtype: float64Of course, an easier and faster way to do this is with resample (we'll discuss this in much more depth in Resampling and Frequency Conversion):

In [109]: ts.resample("M").mean()

Out[109]:

2000-01-31 -0.005833

2000-02-29 0.015894

2000-03-31 0.150209

Freq: M, dtype: float6411.4 Time Zone Handling

Working with time zones can be one of the most unpleasant parts of time series manipulation. As a result, many time series users choose to work with time series in coordinated universal time or UTC, which is the geography-independent international standard. Time zones are expressed as offsets from UTC; for example, New York is four hours behind UTC during daylight saving time (DST) and five hours behind the rest of the year.

In Python, time zone information comes from the third-party pytz library (installable with pip or conda), which exposes the Olson database, a compilation of world time zone information. This is especially important for historical data because the DST transition dates (and even UTC offsets) have been changed numerous times depending on the regional laws. In the United States, the DST transition times have been changed many times since 1900!

For detailed information about the pytz library, you’ll need to look at that library’s documentation. As far as this book is concerned, pandas wraps pytz’s functionality so you can ignore its API outside of the time zone names. Since pandas has a hard dependency on pytz, it isn't necessary to install it separately. Time zone names can be found interactively and in the docs:

In [110]: import pytz

In [111]: pytz.common_timezones[-5:]

Out[111]: ['US/Eastern', 'US/Hawaii', 'US/Mountain', 'US/Pacific', 'UTC']To get a time zone object from pytz, use pytz.timezone:

In [112]: tz = pytz.timezone("America/New_York")

In [113]: tz

Out[113]: <DstTzInfo 'America/New_York' LMT-1 day, 19:04:00 STD>Methods in pandas will accept either time zone names or these objects.

Time Zone Localization and Conversion

By default, time series in pandas are time zone naive. For example, consider the following time series:

In [114]: dates = pd.date_range("2012-03-09 09:30", periods=6)

In [115]: ts = pd.Series(np.random.standard_normal(len(dates)), index=dates)

In [116]: ts

Out[116]:

2012-03-09 09:30:00 -0.202469

2012-03-10 09:30:00 0.050718

2012-03-11 09:30:00 0.639869

2012-03-12 09:30:00 0.597594

2012-03-13 09:30:00 -0.797246

2012-03-14 09:30:00 0.472879

Freq: D, dtype: float64The index’s tz field is None:

In [117]: print(ts.index.tz)

NoneDate ranges can be generated with a time zone set:

In [118]: pd.date_range("2012-03-09 09:30", periods=10, tz="UTC")

Out[118]:

DatetimeIndex(['2012-03-09 09:30:00+00:00', '2012-03-10 09:30:00+00:00',

'2012-03-11 09:30:00+00:00', '2012-03-12 09:30:00+00:00',

'2012-03-13 09:30:00+00:00', '2012-03-14 09:30:00+00:00',

'2012-03-15 09:30:00+00:00', '2012-03-16 09:30:00+00:00',

'2012-03-17 09:30:00+00:00', '2012-03-18 09:30:00+00:00'],

dtype='datetime64[ns, UTC]', freq='D')Conversion from naive to localized (reinterpreted as having been observed in a particular time zone) is handled by the tz_localize method:

In [119]: ts

Out[119]:

2012-03-09 09:30:00 -0.202469

2012-03-10 09:30:00 0.050718

2012-03-11 09:30:00 0.639869

2012-03-12 09:30:00 0.597594

2012-03-13 09:30:00 -0.797246

2012-03-14 09:30:00 0.472879

Freq: D, dtype: float64

In [120]: ts_utc = ts.tz_localize("UTC")

In [121]: ts_utc

Out[121]:

2012-03-09 09:30:00+00:00 -0.202469

2012-03-10 09:30:00+00:00 0.050718

2012-03-11 09:30:00+00:00 0.639869

2012-03-12 09:30:00+00:00 0.597594

2012-03-13 09:30:00+00:00 -0.797246

2012-03-14 09:30:00+00:00 0.472879

Freq: D, dtype: float64

In [122]: ts_utc.index

Out[122]:

DatetimeIndex(['2012-03-09 09:30:00+00:00', '2012-03-10 09:30:00+00:00',

'2012-03-11 09:30:00+00:00', '2012-03-12 09:30:00+00:00',

'2012-03-13 09:30:00+00:00', '2012-03-14 09:30:00+00:00'],

dtype='datetime64[ns, UTC]', freq='D')Once a time series has been localized to a particular time zone, it can be converted to another time zone with tz_convert:

In [123]: ts_utc.tz_convert("America/New_York")

Out[123]:

2012-03-09 04:30:00-05:00 -0.202469

2012-03-10 04:30:00-05:00 0.050718

2012-03-11 05:30:00-04:00 0.639869

2012-03-12 05:30:00-04:00 0.597594

2012-03-13 05:30:00-04:00 -0.797246

2012-03-14 05:30:00-04:00 0.472879

Freq: D, dtype: float64In the case of the preceding time series, which straddles a DST transition in the America/New_York time zone, we could localize to US Eastern time and convert to, say, UTC or Berlin time:

In [124]: ts_eastern = ts.tz_localize("America/New_York")

In [125]: ts_eastern.tz_convert("UTC")

Out[125]:

2012-03-09 14:30:00+00:00 -0.202469

2012-03-10 14:30:00+00:00 0.050718

2012-03-11 13:30:00+00:00 0.639869

2012-03-12 13:30:00+00:00 0.597594

2012-03-13 13:30:00+00:00 -0.797246

2012-03-14 13:30:00+00:00 0.472879

dtype: float64

In [126]: ts_eastern.tz_convert("Europe/Berlin")

Out[126]:

2012-03-09 15:30:00+01:00 -0.202469

2012-03-10 15:30:00+01:00 0.050718

2012-03-11 14:30:00+01:00 0.639869

2012-03-12 14:30:00+01:00 0.597594

2012-03-13 14:30:00+01:00 -0.797246

2012-03-14 14:30:00+01:00 0.472879

dtype: float64tz_localize and tz_convert are also instance methods on DatetimeIndex:

In [127]: ts.index.tz_localize("Asia/Shanghai")

Out[127]:

DatetimeIndex(['2012-03-09 09:30:00+08:00', '2012-03-10 09:30:00+08:00',

'2012-03-11 09:30:00+08:00', '2012-03-12 09:30:00+08:00',

'2012-03-13 09:30:00+08:00', '2012-03-14 09:30:00+08:00'],

dtype='datetime64[ns, Asia/Shanghai]', freq=None)Localizing naive timestamps also checks for ambiguous or non-existent times around daylight saving time transitions.

Operations with Time Zone-Aware Timestamp Objects

Similar to time series and date ranges, individual Timestamp objects similarly can be localized from naive to time zone-aware and converted from one time zone to another:

In [128]: stamp = pd.Timestamp("2011-03-12 04:00")

In [129]: stamp_utc = stamp.tz_localize("utc")

In [130]: stamp_utc.tz_convert("America/New_York")

Out[130]: Timestamp('2011-03-11 23:00:00-0500', tz='America/New_York')You can also pass a time zone when creating the Timestamp:

In [131]: stamp_moscow = pd.Timestamp("2011-03-12 04:00", tz="Europe/Moscow")

In [132]: stamp_moscow

Out[132]: Timestamp('2011-03-12 04:00:00+0300', tz='Europe/Moscow')Time zone-aware Timestamp objects internally store a UTC timestamp value as nanoseconds since the Unix epoch (January 1, 1970), so changing the time zone does not alter the internal UTC value:

In [133]: stamp_utc.value

Out[133]: 1299902400000000000

In [134]: stamp_utc.tz_convert("America/New_York").value

Out[134]: 1299902400000000000When performing time arithmetic using pandas’s DateOffset objects, pandas respects daylight saving time transitions where possible. Here we construct timestamps that occur right before DST transitions (forward and backward). First, 30 minutes before transitioning to DST:

In [135]: stamp = pd.Timestamp("2012-03-11 01:30", tz="US/Eastern")

In [136]: stamp

Out[136]: Timestamp('2012-03-11 01:30:00-0500', tz='US/Eastern')

In [137]: stamp + Hour()

Out[137]: Timestamp('2012-03-11 03:30:00-0400', tz='US/Eastern')Then, 90 minutes before transitioning out of DST:

In [138]: stamp = pd.Timestamp("2012-11-04 00:30", tz="US/Eastern")

In [139]: stamp

Out[139]: Timestamp('2012-11-04 00:30:00-0400', tz='US/Eastern')

In [140]: stamp + 2 * Hour()

Out[140]: Timestamp('2012-11-04 01:30:00-0500', tz='US/Eastern')Operations Between Different Time Zones

If two time series with different time zones are combined, the result will be UTC. Since the timestamps are stored under the hood in UTC, this is a straightforward operation and requires no conversion:

In [141]: dates = pd.date_range("2012-03-07 09:30", periods=10, freq="B")

In [142]: ts = pd.Series(np.random.standard_normal(len(dates)), index=dates)

In [143]: ts

Out[143]:

2012-03-07 09:30:00 0.522356

2012-03-08 09:30:00 -0.546348

2012-03-09 09:30:00 -0.733537

2012-03-12 09:30:00 1.302736

2012-03-13 09:30:00 0.022199

2012-03-14 09:30:00 0.364287

2012-03-15 09:30:00 -0.922839

2012-03-16 09:30:00 0.312656

2012-03-19 09:30:00 -1.128497

2012-03-20 09:30:00 -0.333488

Freq: B, dtype: float64

In [144]: ts1 = ts[:7].tz_localize("Europe/London")

In [145]: ts2 = ts1[2:].tz_convert("Europe/Moscow")

In [146]: result = ts1 + ts2

In [147]: result.index

Out[147]:

DatetimeIndex(['2012-03-07 09:30:00+00:00', '2012-03-08 09:30:00+00:00',

'2012-03-09 09:30:00+00:00', '2012-03-12 09:30:00+00:00',

'2012-03-13 09:30:00+00:00', '2012-03-14 09:30:00+00:00',

'2012-03-15 09:30:00+00:00'],

dtype='datetime64[ns, UTC]', freq=None)Operations between time zone-naive and time zone-aware data are not supported and will raise an exception.

11.5 Periods and Period Arithmetic

Periods represent time spans, like days, months, quarters, or years. The pandas.Period class represents this data type, requiring a string or integer and a supported frequency from Table 11.4:

In [148]: p = pd.Period("2011", freq="A-DEC")

In [149]: p

Out[149]: Period('2011', 'A-DEC')In this case, the Period object represents the full time span from January 1, 2011, to December 31, 2011, inclusive. Conveniently, adding and subtracting integers from periods has the effect of shifting their frequency:

In [150]: p + 5

Out[150]: Period('2016', 'A-DEC')

In [151]: p - 2

Out[151]: Period('2009', 'A-DEC')If two periods have the same frequency, their difference is the number of units between them as a date offset:

In [152]: pd.Period("2014", freq="A-DEC") - p

Out[152]: <3 * YearEnds: month=12>Regular ranges of periods can be constructed with the period_range function:

In [153]: periods = pd.period_range("2000-01-01", "2000-06-30", freq="M")

In [154]: periods

Out[154]: PeriodIndex(['2000-01', '2000-02', '2000-03', '2000-04', '2000-05', '20

00-06'], dtype='period[M]')The PeriodIndex class stores a sequence of periods and can serve as an axis index in any pandas data structure:

In [155]: pd.Series(np.random.standard_normal(6), index=periods)

Out[155]:

2000-01 -0.514551

2000-02 -0.559782

2000-03 -0.783408

2000-04 -1.797685

2000-05 -0.172670

2000-06 0.680215

Freq: M, dtype: float64If you have an array of strings, you can also use the PeriodIndex class, where all of its values are periods:

In [156]: values = ["2001Q3", "2002Q2", "2003Q1"]

In [157]: index = pd.PeriodIndex(values, freq="Q-DEC")

In [158]: index

Out[158]: PeriodIndex(['2001Q3', '2002Q2', '2003Q1'], dtype='period[Q-DEC]')Period Frequency Conversion

Periods and PeriodIndex objects can be converted to another frequency with their asfreq method. As an example, suppose we had an annual period and wanted to convert it into a monthly period either at the start or end of the year. This can be done like so:

In [159]: p = pd.Period("2011", freq="A-DEC")

In [160]: p

Out[160]: Period('2011', 'A-DEC')

In [161]: p.asfreq("M", how="start")

Out[161]: Period('2011-01', 'M')

In [162]: p.asfreq("M", how="end")

Out[162]: Period('2011-12', 'M')

In [163]: p.asfreq("M")

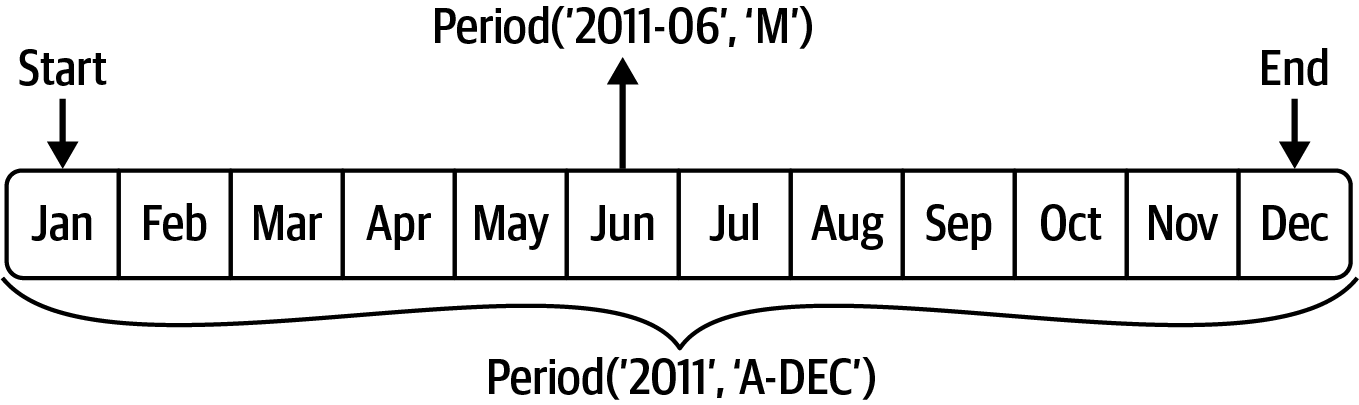

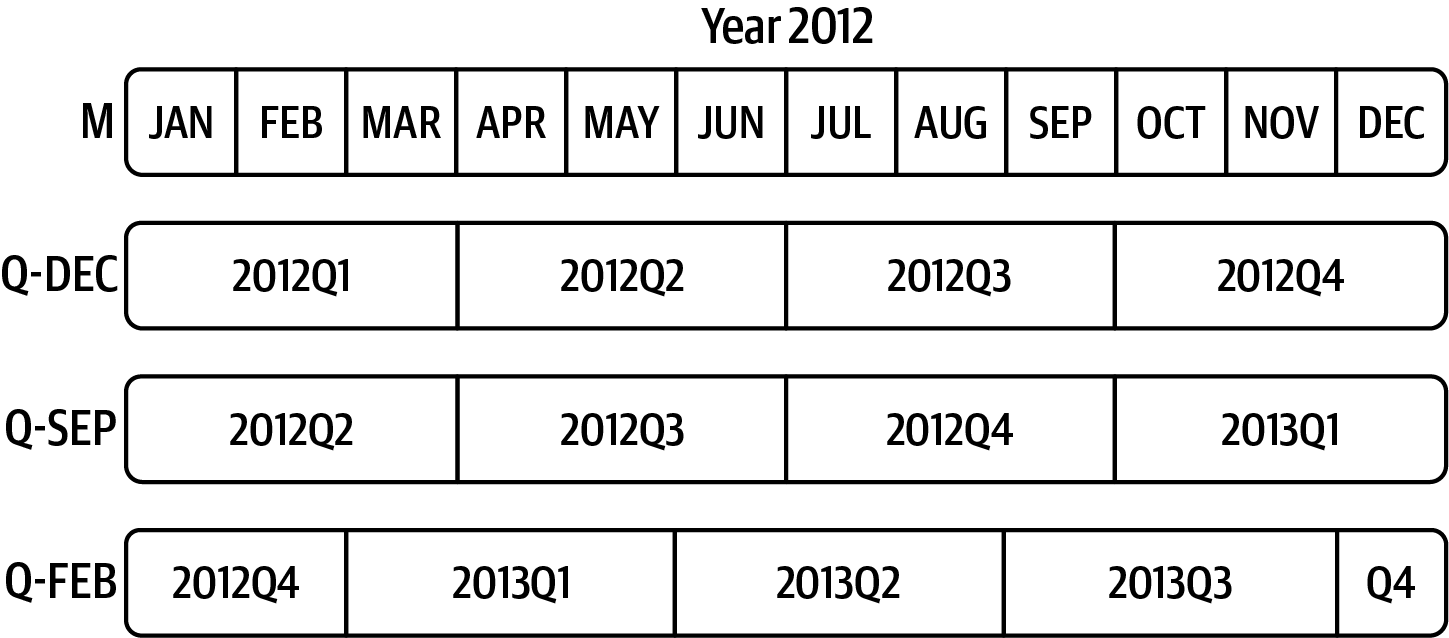

Out[163]: Period('2011-12', 'M')You can think of Period("2011", "A-DEC") as being a sort of cursor pointing to a span of time, subdivided by monthly periods. See Figure 11.1 for an illustration of this. For a fiscal year ending on a month other than December, the corresponding monthly subperiods are different:

In [164]: p = pd.Period("2011", freq="A-JUN")

In [165]: p

Out[165]: Period('2011', 'A-JUN')

In [166]: p.asfreq("M", how="start")

Out[166]: Period('2010-07', 'M')

In [167]: p.asfreq("M", how="end")

Out[167]: Period('2011-06', 'M')When you are converting from high to low frequency, pandas determines the subperiod, depending on where the superperiod “belongs.” For example, in A-JUN frequency, the month Aug-2011 is actually part of the 2012 period:

In [168]: p = pd.Period("Aug-2011", "M")

In [169]: p.asfreq("A-JUN")

Out[169]: Period('2012', 'A-JUN')Whole PeriodIndex objects or time series can be similarly converted with the same semantics:

In [170]: periods = pd.period_range("2006", "2009", freq="A-DEC")

In [171]: ts = pd.Series(np.random.standard_normal(len(periods)), index=periods)

In [172]: ts

Out[172]:

2006 1.607578

2007 0.200381

2008 -0.834068

2009 -0.302988

Freq: A-DEC, dtype: float64

In [173]: ts.asfreq("M", how="start")

Out[173]:

2006-01 1.607578

2007-01 0.200381

2008-01 -0.834068

2009-01 -0.302988

Freq: M, dtype: float64Here, the annual periods are replaced with monthly periods corresponding to the first month falling within each annual period. If we instead wanted the last business day of each year, we can use the "B" frequency and indicate that we want the end of the period:

In [174]: ts.asfreq("B", how="end")

Out[174]:

2006-12-29 1.607578

2007-12-31 0.200381

2008-12-31 -0.834068

2009-12-31 -0.302988

Freq: B, dtype: float64Quarterly Period Frequencies

Quarterly data is standard in accounting, finance, and other fields. Much quarterly data is reported relative to a fiscal year end, typically the last calendar or business day of one of the 12 months of the year. Thus, the period 2012Q4 has a different meaning depending on fiscal year end. pandas supports all 12 possible quarterly frequencies as Q-JAN through Q-DEC:

In [175]: p = pd.Period("2012Q4", freq="Q-JAN")

In [176]: p

Out[176]: Period('2012Q4', 'Q-JAN')In the case of a fiscal year ending in January, 2012Q4 runs from November 2011 through January 2012, which you can check by converting to daily frequency:

In [177]: p.asfreq("D", how="start")

Out[177]: Period('2011-11-01', 'D')

In [178]: p.asfreq("D", how="end")

Out[178]: Period('2012-01-31', 'D')See Figure 11.2 for an illustration.

Thus, it’s possible to do convenient period arithmetic; for example, to get the timestamp at 4 P.M. on the second-to-last business day of the quarter, you could do:

In [179]: p4pm = (p.asfreq("B", how="end") - 1).asfreq("T", how="start") + 16 * 6

0

In [180]: p4pm

Out[180]: Period('2012-01-30 16:00', 'T')

In [181]: p4pm.to_timestamp()

Out[181]: Timestamp('2012-01-30 16:00:00')The to_timestamp method returns the Timestamp at the start of the period by default.

You can generate quarterly ranges using pandas.period_range. The arithmetic is identical, too:

In [182]: periods = pd.period_range("2011Q3", "2012Q4", freq="Q-JAN")

In [183]: ts = pd.Series(np.arange(len(periods)), index=periods)

In [184]: ts

Out[184]:

2011Q3 0

2011Q4 1

2012Q1 2

2012Q2 3

2012Q3 4

2012Q4 5

Freq: Q-JAN, dtype: int64

In [185]: new_periods = (periods.asfreq("B", "end") - 1).asfreq("H", "start") + 1

6

In [186]: ts.index = new_periods.to_timestamp()

In [187]: ts

Out[187]:

2010-10-28 16:00:00 0

2011-01-28 16:00:00 1

2011-04-28 16:00:00 2

2011-07-28 16:00:00 3

2011-10-28 16:00:00 4

2012-01-30 16:00:00 5

dtype: int64Converting Timestamps to Periods (and Back)

Series and DataFrame objects indexed by timestamps can be converted to periods with the to_period method:

In [188]: dates = pd.date_range("2000-01-01", periods=3, freq="M")

In [189]: ts = pd.Series(np.random.standard_normal(3), index=dates)

In [190]: ts

Out[190]:

2000-01-31 1.663261

2000-02-29 -0.996206

2000-03-31 1.521760

Freq: M, dtype: float64

In [191]: pts = ts.to_period()

In [192]: pts

Out[192]:

2000-01 1.663261

2000-02 -0.996206

2000-03 1.521760

Freq: M, dtype: float64Since periods refer to nonoverlapping time spans, a timestamp can only belong to a single period for a given frequency. While the frequency of the new PeriodIndex is inferred from the timestamps by default, you can specify any supported frequency (most of those listed in Table 11.4 are supported). There is also no problem with having duplicate periods in the result:

In [193]: dates = pd.date_range("2000-01-29", periods=6)

In [194]: ts2 = pd.Series(np.random.standard_normal(6), index=dates)

In [195]: ts2

Out[195]:

2000-01-29 0.244175

2000-01-30 0.423331

2000-01-31 -0.654040

2000-02-01 2.089154

2000-02-02 -0.060220

2000-02-03 -0.167933

Freq: D, dtype: float64

In [196]: ts2.to_period("M")

Out[196]:

2000-01 0.244175

2000-01 0.423331

2000-01 -0.654040

2000-02 2.089154

2000-02 -0.060220

2000-02 -0.167933

Freq: M, dtype: float64To convert back to timestamps, use the to_timestamp method, which returns a DatetimeIndex:

In [197]: pts = ts2.to_period()

In [198]: pts

Out[198]:

2000-01-29 0.244175

2000-01-30 0.423331

2000-01-31 -0.654040

2000-02-01 2.089154

2000-02-02 -0.060220

2000-02-03 -0.167933

Freq: D, dtype: float64

In [199]: pts.to_timestamp(how="end")

Out[199]:

2000-01-29 23:59:59.999999999 0.244175

2000-01-30 23:59:59.999999999 0.423331

2000-01-31 23:59:59.999999999 -0.654040

2000-02-01 23:59:59.999999999 2.089154

2000-02-02 23:59:59.999999999 -0.060220

2000-02-03 23:59:59.999999999 -0.167933

Freq: D, dtype: float64Creating a PeriodIndex from Arrays

Fixed frequency datasets are sometimes stored with time span information spread across multiple columns. For example, in this macroeconomic dataset, the year and quarter are in different columns:

In [200]: data = pd.read_csv("examples/macrodata.csv")

In [201]: data.head(5)

Out[201]:

year quarter realgdp realcons realinv realgovt realdpi cpi

0 1959 1 2710.349 1707.4 286.898 470.045 1886.9 28.98 \

1 1959 2 2778.801 1733.7 310.859 481.301 1919.7 29.15

2 1959 3 2775.488 1751.8 289.226 491.260 1916.4 29.35

3 1959 4 2785.204 1753.7 299.356 484.052 1931.3 29.37

4 1960 1 2847.699 1770.5 331.722 462.199 1955.5 29.54

m1 tbilrate unemp pop infl realint

0 139.7 2.82 5.8 177.146 0.00 0.00

1 141.7 3.08 5.1 177.830 2.34 0.74

2 140.5 3.82 5.3 178.657 2.74 1.09

3 140.0 4.33 5.6 179.386 0.27 4.06

4 139.6 3.50 5.2 180.007 2.31 1.19

In [202]: data["year"]

Out[202]:

0 1959

1 1959

2 1959

3 1959

4 1960

...

198 2008

199 2008

200 2009

201 2009

202 2009

Name: year, Length: 203, dtype: int64

In [203]: data["quarter"]

Out[203]:

0 1

1 2

2 3

3 4

4 1

..

198 3

199 4

200 1

201 2

202 3

Name: quarter, Length: 203, dtype: int64By passing these arrays to PeriodIndex with a frequency, you can combine them to form an index for the DataFrame:

In [204]: index = pd.PeriodIndex(year=data["year"], quarter=data["quarter"],

.....: freq="Q-DEC")

In [205]: index

Out[205]:

PeriodIndex(['1959Q1', '1959Q2', '1959Q3', '1959Q4', '1960Q1', '1960Q2',

'1960Q3', '1960Q4', '1961Q1', '1961Q2',

...

'2007Q2', '2007Q3', '2007Q4', '2008Q1', '2008Q2', '2008Q3',

'2008Q4', '2009Q1', '2009Q2', '2009Q3'],

dtype='period[Q-DEC]', length=203)

In [206]: data.index = index

In [207]: data["infl"]

Out[207]:

1959Q1 0.00

1959Q2 2.34

1959Q3 2.74

1959Q4 0.27

1960Q1 2.31

...

2008Q3 -3.16

2008Q4 -8.79

2009Q1 0.94

2009Q2 3.37

2009Q3 3.56

Freq: Q-DEC, Name: infl, Length: 203, dtype: float6411.6 Resampling and Frequency Conversion

Resampling refers to the process of converting a time series from one frequency to another. Aggregating higher frequency data to lower frequency is called downsampling, while converting lower frequency to higher frequency is called upsampling. Not all resampling falls into either of these categories; for example, converting W-WED (weekly on Wednesday) to W-FRI is neither upsampling nor downsampling.

pandas objects are equipped with a resample method, which is the workhorse function for all frequency conversion. resample has a similar API to groupby; you call resample to group the data, then call an aggregation function:

In [208]: dates = pd.date_range("2000-01-01", periods=100)

In [209]: ts = pd.Series(np.random.standard_normal(len(dates)), index=dates)

In [210]: ts

Out[210]:

2000-01-01 0.631634

2000-01-02 -1.594313

2000-01-03 -1.519937

2000-01-04 1.108752

2000-01-05 1.255853

...

2000-04-05 -0.423776

2000-04-06 0.789740

2000-04-07 0.937568

2000-04-08 -2.253294

2000-04-09 -1.772919

Freq: D, Length: 100, dtype: float64

In [211]: ts.resample("M").mean()

Out[211]:

2000-01-31 -0.165893

2000-02-29 0.078606

2000-03-31 0.223811

2000-04-30 -0.063643

Freq: M, dtype: float64

In [212]: ts.resample("M", kind="period").mean()

Out[212]:

2000-01 -0.165893

2000-02 0.078606

2000-03 0.223811

2000-04 -0.063643

Freq: M, dtype: float64resample is a flexible method that can be used to process large time series. The examples in the following sections illustrate its semantics and use. Table 11.5 summarizes some of its options.

| Argument | Description |

|---|---|

rule |

String, DateOffset, or timedelta indicating desired resampled frequency (for example, ’M', ’5min', or Second(15)) |

axis |

Axis to resample on; default axis=0 |

fill_method |

How to interpolate when upsampling, as in "ffill" or "bfill"; by default does no interpolation |

closed |

In downsampling, which end of each interval is closed (inclusive), "right" or "left" |

label |

In downsampling, how to label the aggregated result, with the "right" or "left" bin edge (e.g., the 9:30 to 9:35 five-minute interval could be labeled 9:30 or 9:35) |

limit |

When forward or backward filling, the maximum number of periods to fill |

kind |

Aggregate to periods ("period") or timestamps ("timestamp"); defaults to the type of index the time series has |

convention |

When resampling periods, the convention ("start" or "end") for converting the low-frequency period to high frequency; defaults to "start" |

origin |

The "base" timestamp from which to determine the resampling bin edges; can also be one of "epoch", "start", "start_day", "end", or "end_day"; see the resample docstring for full details |

offset |

An offset timedelta added to the origin; defaults to None |

Downsampling

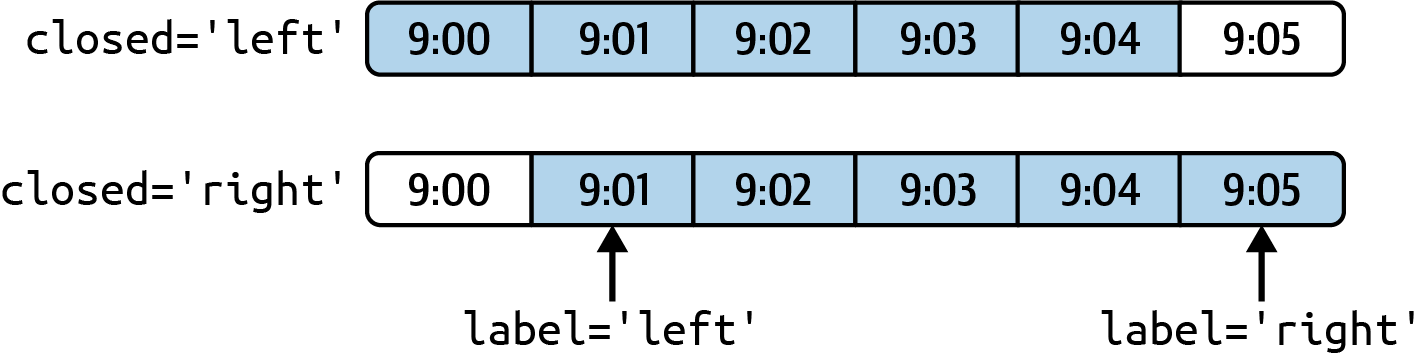

Downsampling is aggregating data to a regular, lower frequency. The data you’re aggregating doesn’t need to be fixed frequently; the desired frequency defines bin edges that are used to slice the time series into pieces to aggregate. For example, to convert to monthly, "M" or "BM", you need to chop up the data into one-month intervals. Each interval is said to be half-open; a data point can belong only to one interval, and the union of the intervals must make up the whole time frame. There are a couple things to think about when using resample to downsample data:

Which side of each interval is closed

How to label each aggregated bin, either with the start of the interval or the end

To illustrate, let’s look at some one-minute frequency data:

In [213]: dates = pd.date_range("2000-01-01", periods=12, freq="T")

In [214]: ts = pd.Series(np.arange(len(dates)), index=dates)

In [215]: ts

Out[215]:

2000-01-01 00:00:00 0

2000-01-01 00:01:00 1

2000-01-01 00:02:00 2

2000-01-01 00:03:00 3

2000-01-01 00:04:00 4

2000-01-01 00:05:00 5

2000-01-01 00:06:00 6

2000-01-01 00:07:00 7

2000-01-01 00:08:00 8

2000-01-01 00:09:00 9

2000-01-01 00:10:00 10

2000-01-01 00:11:00 11

Freq: T, dtype: int64Suppose you wanted to aggregate this data into five-minute chunks or bars by taking the sum of each group:

In [216]: ts.resample("5min").sum()

Out[216]:

2000-01-01 00:00:00 10

2000-01-01 00:05:00 35

2000-01-01 00:10:00 21

Freq: 5T, dtype: int64The frequency you pass defines bin edges in five-minute increments. For this frequency, by default the left bin edge is inclusive, so the 00:00 value is included in the 00:00 to 00:05 interval, and the 00:05 value is excluded from that interval.1

In [217]: ts.resample("5min", closed="right").sum()

Out[217]:

1999-12-31 23:55:00 0

2000-01-01 00:00:00 15

2000-01-01 00:05:00 40

2000-01-01 00:10:00 11

Freq: 5T, dtype: int64The resulting time series is labeled by the timestamps from the left side of each bin. By passing label="right" you can label them with the right bin edge:

In [218]: ts.resample("5min", closed="right", label="right").sum()

Out[218]:

2000-01-01 00:00:00 0

2000-01-01 00:05:00 15

2000-01-01 00:10:00 40

2000-01-01 00:15:00 11

Freq: 5T, dtype: int64See Figure 11.3 for an illustration of minute frequency data being resampled to five-minute frequency.

Lastly, you might want to shift the result index by some amount, say subtracting one second from the right edge to make it more clear which interval the timestamp refers to. To do this, add an offset to the resulting index:

In [219]: from pandas.tseries.frequencies import to_offset

In [220]: result = ts.resample("5min", closed="right", label="right").sum()

In [221]: result.index = result.index + to_offset("-1s")

In [222]: result

Out[222]:

1999-12-31 23:59:59 0

2000-01-01 00:04:59 15

2000-01-01 00:09:59 40

2000-01-01 00:14:59 11

Freq: 5T, dtype: int64Open-high-low-close (OHLC) resampling

In finance, a popular way to aggregate a time series is to compute four values for each bucket: the first (open), last (close), maximum (high), and minimal (low) values. By using the ohlc aggregate function, you will obtain a DataFrame having columns containing these four aggregates, which are efficiently computed in a single function call:

In [223]: ts = pd.Series(np.random.permutation(np.arange(len(dates))), index=date

s)

In [224]: ts.resample("5min").ohlc()

Out[224]:

open high low close

2000-01-01 00:00:00 8 8 1 5

2000-01-01 00:05:00 6 11 2 2

2000-01-01 00:10:00 0 7 0 7Upsampling and Interpolation

Upsampling is converting from a lower frequency to a higher frequency, where no aggregation is needed. Let’s consider a DataFrame with some weekly data:

In [225]: frame = pd.DataFrame(np.random.standard_normal((2, 4)),

.....: index=pd.date_range("2000-01-01", periods=2,

.....: freq="W-WED"),

.....: columns=["Colorado", "Texas", "New York", "Ohio"])

In [226]: frame

Out[226]:

Colorado Texas New York Ohio

2000-01-05 -0.896431 0.927238 0.482284 -0.867130

2000-01-12 0.493841 -0.155434 1.397286 1.507055When you are using an aggregation function with this data, there is only one value per group, and missing values result in the gaps. We use the asfreq method to convert to the higher frequency without any aggregation:

In [227]: df_daily = frame.resample("D").asfreq()

In [228]: df_daily

Out[228]:

Colorado Texas New York Ohio

2000-01-05 -0.896431 0.927238 0.482284 -0.867130

2000-01-06 NaN NaN NaN NaN

2000-01-07 NaN NaN NaN NaN

2000-01-08 NaN NaN NaN NaN

2000-01-09 NaN NaN NaN NaN

2000-01-10 NaN NaN NaN NaN

2000-01-11 NaN NaN NaN NaN

2000-01-12 0.493841 -0.155434 1.397286 1.507055Suppose you wanted to fill forward each weekly value on the non-Wednesdays. The same filling or interpolation methods available in the fillna and reindex methods are available for resampling:

In [229]: frame.resample("D").ffill()

Out[229]:

Colorado Texas New York Ohio

2000-01-05 -0.896431 0.927238 0.482284 -0.867130

2000-01-06 -0.896431 0.927238 0.482284 -0.867130

2000-01-07 -0.896431 0.927238 0.482284 -0.867130

2000-01-08 -0.896431 0.927238 0.482284 -0.867130

2000-01-09 -0.896431 0.927238 0.482284 -0.867130

2000-01-10 -0.896431 0.927238 0.482284 -0.867130

2000-01-11 -0.896431 0.927238 0.482284 -0.867130

2000-01-12 0.493841 -0.155434 1.397286 1.507055You can similarly choose to only fill a certain number of periods forward to limit how far to continue using an observed value:

In [230]: frame.resample("D").ffill(limit=2)

Out[230]:

Colorado Texas New York Ohio

2000-01-05 -0.896431 0.927238 0.482284 -0.867130

2000-01-06 -0.896431 0.927238 0.482284 -0.867130

2000-01-07 -0.896431 0.927238 0.482284 -0.867130

2000-01-08 NaN NaN NaN NaN

2000-01-09 NaN NaN NaN NaN

2000-01-10 NaN NaN NaN NaN

2000-01-11 NaN NaN NaN NaN

2000-01-12 0.493841 -0.155434 1.397286 1.507055Notably, the new date index need not coincide with the old one at all:

In [231]: frame.resample("W-THU").ffill()

Out[231]:

Colorado Texas New York Ohio

2000-01-06 -0.896431 0.927238 0.482284 -0.867130

2000-01-13 0.493841 -0.155434 1.397286 1.507055Resampling with Periods

Resampling data indexed by periods is similar to timestamps:

In [232]: frame = pd.DataFrame(np.random.standard_normal((24, 4)),

.....: index=pd.period_range("1-2000", "12-2001",

.....: freq="M"),

.....: columns=["Colorado", "Texas", "New York", "Ohio"])

In [233]: frame.head()

Out[233]:

Colorado Texas New York Ohio

2000-01 -1.179442 0.443171 1.395676 -0.529658

2000-02 0.787358 0.248845 0.743239 1.267746

2000-03 1.302395 -0.272154 -0.051532 -0.467740

2000-04 -1.040816 0.426419 0.312945 -1.115689

2000-05 1.234297 -1.893094 -1.661605 -0.005477

In [234]: annual_frame = frame.resample("A-DEC").mean()

In [235]: annual_frame

Out[235]:

Colorado Texas New York Ohio

2000 0.487329 0.104466 0.020495 -0.273945

2001 0.203125 0.162429 0.056146 -0.103794Upsampling is more nuanced, as before resampling you must make a decision about which end of the time span in the new frequency to place the values. The convention argument defaults to "start" but can also be "end":

# Q-DEC: Quarterly, year ending in December

In [236]: annual_frame.resample("Q-DEC").ffill()

Out[236]:

Colorado Texas New York Ohio

2000Q1 0.487329 0.104466 0.020495 -0.273945

2000Q2 0.487329 0.104466 0.020495 -0.273945

2000Q3 0.487329 0.104466 0.020495 -0.273945

2000Q4 0.487329 0.104466 0.020495 -0.273945

2001Q1 0.203125 0.162429 0.056146 -0.103794

2001Q2 0.203125 0.162429 0.056146 -0.103794

2001Q3 0.203125 0.162429 0.056146 -0.103794

2001Q4 0.203125 0.162429 0.056146 -0.103794

In [237]: annual_frame.resample("Q-DEC", convention="end").asfreq()

Out[237]:

Colorado Texas New York Ohio

2000Q4 0.487329 0.104466 0.020495 -0.273945

2001Q1 NaN NaN NaN NaN

2001Q2 NaN NaN NaN NaN

2001Q3 NaN NaN NaN NaN

2001Q4 0.203125 0.162429 0.056146 -0.103794Since periods refer to time spans, the rules about upsampling and downsampling are more rigid:

In downsampling, the target frequency must be a subperiod of the source frequency.

In upsampling, the target frequency must be a superperiod of the source frequency.

If these rules are not satisfied, an exception will be raised. This mainly affects the quarterly, annual, and weekly frequencies; for example, the time spans defined by Q-MAR only line up with A-MAR, A-JUN, A-SEP, and A-DEC:

In [238]: annual_frame.resample("Q-MAR").ffill()

Out[238]:

Colorado Texas New York Ohio

2000Q4 0.487329 0.104466 0.020495 -0.273945

2001Q1 0.487329 0.104466 0.020495 -0.273945

2001Q2 0.487329 0.104466 0.020495 -0.273945

2001Q3 0.487329 0.104466 0.020495 -0.273945

2001Q4 0.203125 0.162429 0.056146 -0.103794

2002Q1 0.203125 0.162429 0.056146 -0.103794

2002Q2 0.203125 0.162429 0.056146 -0.103794

2002Q3 0.203125 0.162429 0.056146 -0.103794Grouped Time Resampling

For time series data, the resample method is semantically a group operation based on a time intervalization. Here's a small example table:

In [239]: N = 15

In [240]: times = pd.date_range("2017-05-20 00:00", freq="1min", periods=N)

In [241]: df = pd.DataFrame({"time": times,

.....: "value": np.arange(N)})

In [242]: df

Out[242]:

time value

0 2017-05-20 00:00:00 0

1 2017-05-20 00:01:00 1

2 2017-05-20 00:02:00 2

3 2017-05-20 00:03:00 3

4 2017-05-20 00:04:00 4

5 2017-05-20 00:05:00 5

6 2017-05-20 00:06:00 6

7 2017-05-20 00:07:00 7

8 2017-05-20 00:08:00 8

9 2017-05-20 00:09:00 9

10 2017-05-20 00:10:00 10

11 2017-05-20 00:11:00 11

12 2017-05-20 00:12:00 12

13 2017-05-20 00:13:00 13

14 2017-05-20 00:14:00 14Here, we can index by "time" and then resample:

In [243]: df.set_index("time").resample("5min").count()

Out[243]:

value

time

2017-05-20 00:00:00 5

2017-05-20 00:05:00 5

2017-05-20 00:10:00 5Suppose that a DataFrame contains multiple time series, marked by an additional group key column:

In [244]: df2 = pd.DataFrame({"time": times.repeat(3),

.....: "key": np.tile(["a", "b", "c"], N),

.....: "value": np.arange(N * 3.)})

In [245]: df2.head(7)

Out[245]:

time key value

0 2017-05-20 00:00:00 a 0.0

1 2017-05-20 00:00:00 b 1.0

2 2017-05-20 00:00:00 c 2.0

3 2017-05-20 00:01:00 a 3.0

4 2017-05-20 00:01:00 b 4.0

5 2017-05-20 00:01:00 c 5.0

6 2017-05-20 00:02:00 a 6.0To do the same resampling for each value of "key", we introduce the pandas.Grouper object:

In [246]: time_key = pd.Grouper(freq="5min")We can then set the time index, group by "key" and time_key, and aggregate:

In [247]: resampled = (df2.set_index("time")

.....: .groupby(["key", time_key])

.....: .sum())

In [248]: resampled

Out[248]:

value

key time

a 2017-05-20 00:00:00 30.0

2017-05-20 00:05:00 105.0

2017-05-20 00:10:00 180.0

b 2017-05-20 00:00:00 35.0

2017-05-20 00:05:00 110.0

2017-05-20 00:10:00 185.0

c 2017-05-20 00:00:00 40.0

2017-05-20 00:05:00 115.0

2017-05-20 00:10:00 190.0

In [249]: resampled.reset_index()

Out[249]:

key time value

0 a 2017-05-20 00:00:00 30.0

1 a 2017-05-20 00:05:00 105.0

2 a 2017-05-20 00:10:00 180.0

3 b 2017-05-20 00:00:00 35.0

4 b 2017-05-20 00:05:00 110.0

5 b 2017-05-20 00:10:00 185.0

6 c 2017-05-20 00:00:00 40.0

7 c 2017-05-20 00:05:00 115.0

8 c 2017-05-20 00:10:00 190.0One constraint with using pandas.Grouper is that the time must be the index of the Series or DataFrame.

11.7 Moving Window Functions

An important class of array transformations used for time series operations are statistics and other functions evaluated over a sliding window or with exponentially decaying weights. This can be useful for smoothing noisy or gappy data. I call these moving window functions, even though they include functions without a fixed-length window like exponentially weighted moving average. Like other statistical functions, these also automatically exclude missing data.

Before digging in, we can load up some time series data and resample it to business day frequency:

In [250]: close_px_all = pd.read_csv("examples/stock_px.csv",

.....: parse_dates=True, index_col=0)

In [251]: close_px = close_px_all[["AAPL", "MSFT", "XOM"]]

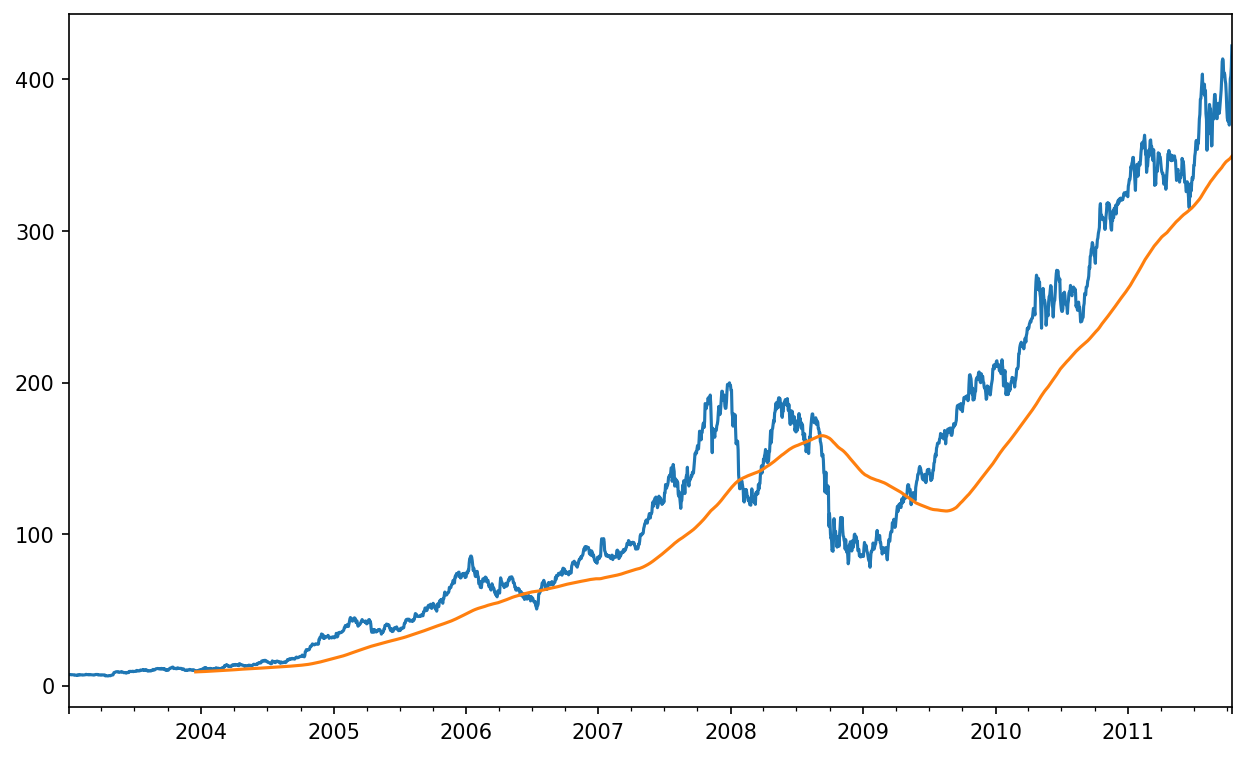

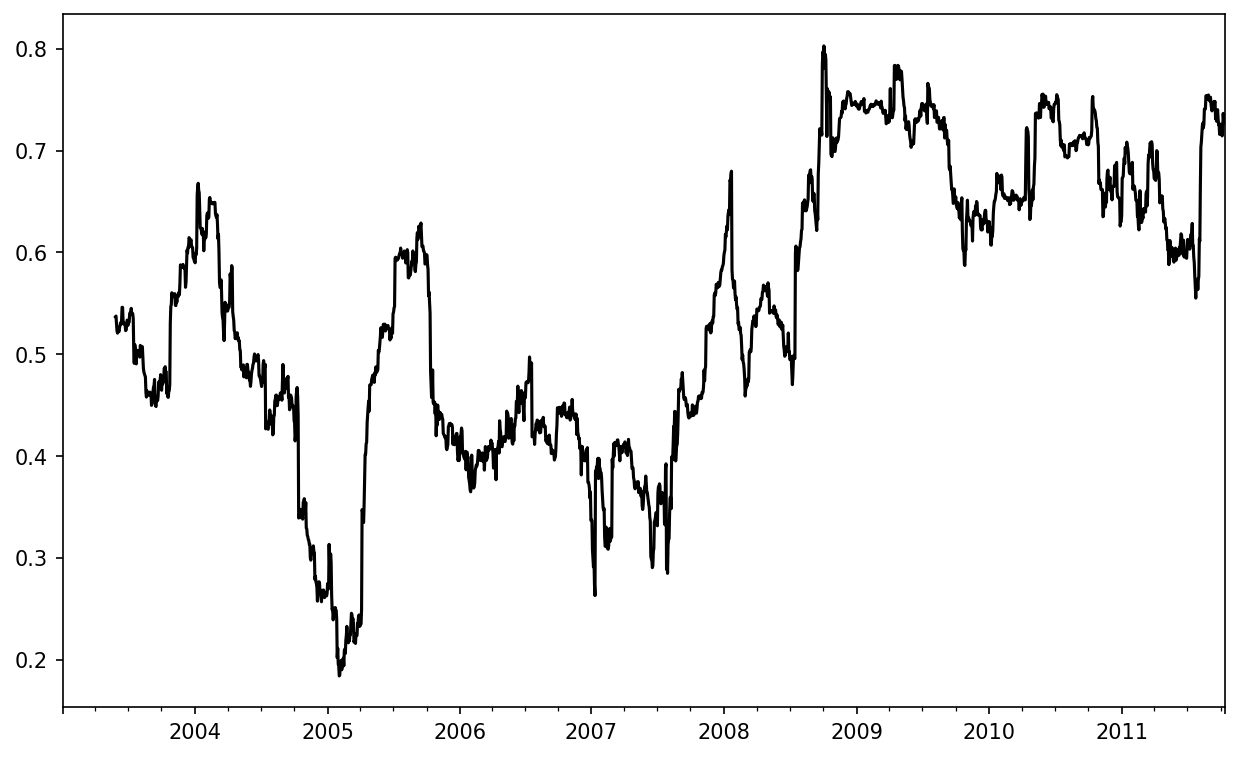

In [252]: close_px = close_px.resample("B").ffill()I now introduce the rolling operator, which behaves similarly to resample and groupby. It can be called on a Series or DataFrame along with a window (expressed as a number of periods; see Apple price with 250-day moving average for the plot created):

In [253]: close_px["AAPL"].plot()

Out[253]: <Axes: >

In [254]: close_px["AAPL"].rolling(250).mean().plot()The expression rolling(250) is similar in behavior to groupby, but instead of grouping, it creates an object that enables grouping over a 250-day sliding window. So here we have the 250-day moving window average of Apple's stock price.

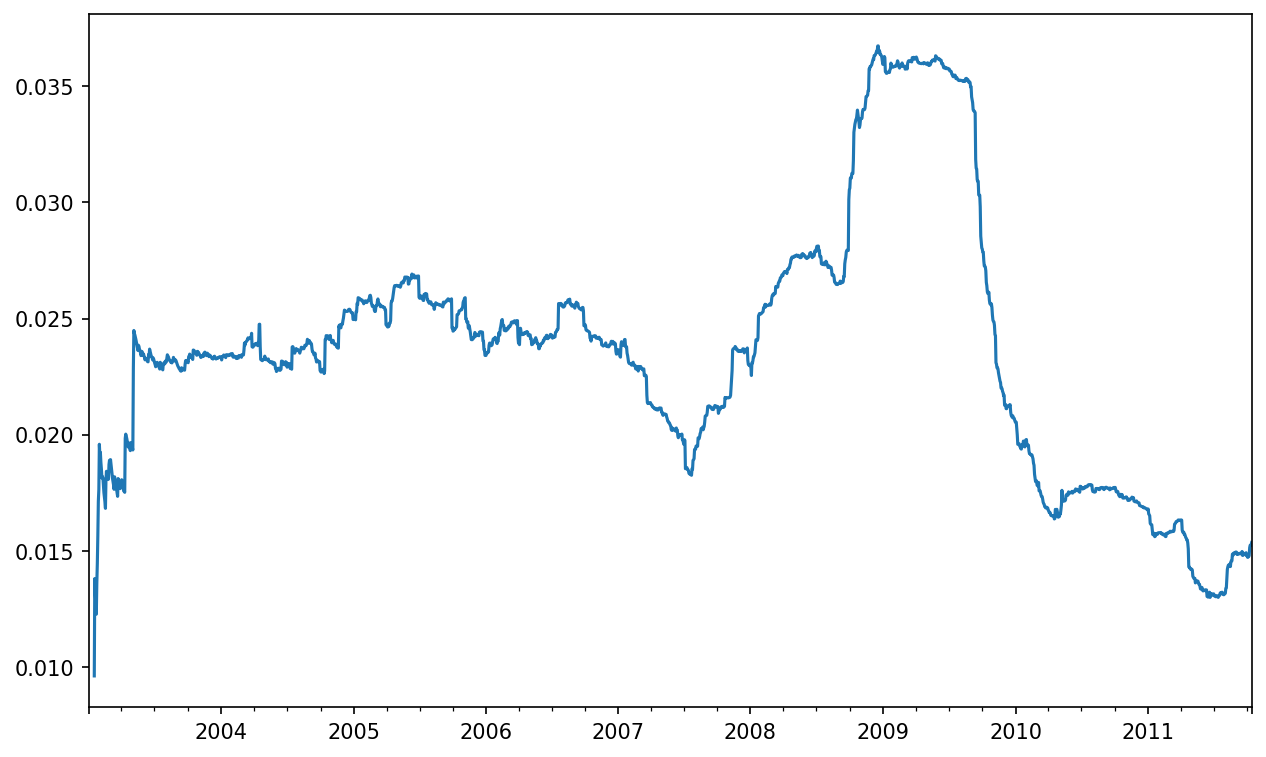

By default, rolling functions require all of the values in the window to be non-NA. This behavior can be changed to account for missing data and, in particular, the fact that you will have fewer than window periods of data at the beginning of the time series (see Apple 250-day daily return standard deviation):

In [255]: plt.figure()

Out[255]: <Figure size 1000x600 with 0 Axes>

In [256]: std250 = close_px["AAPL"].pct_change().rolling(250, min_periods=10).std

()

In [257]: std250[5:12]

Out[257]:

2003-01-09 NaN

2003-01-10 NaN

2003-01-13 NaN

2003-01-14 NaN

2003-01-15 NaN

2003-01-16 0.009628

2003-01-17 0.013818

Freq: B, Name: AAPL, dtype: float64

In [258]: std250.plot()To compute an expanding window mean, use the expanding operator instead of rolling. The expanding mean starts the time window from the same point as the rolling window and increases the size of the window until it encompasses the whole series. An expanding window mean on the std250 time series looks like this:

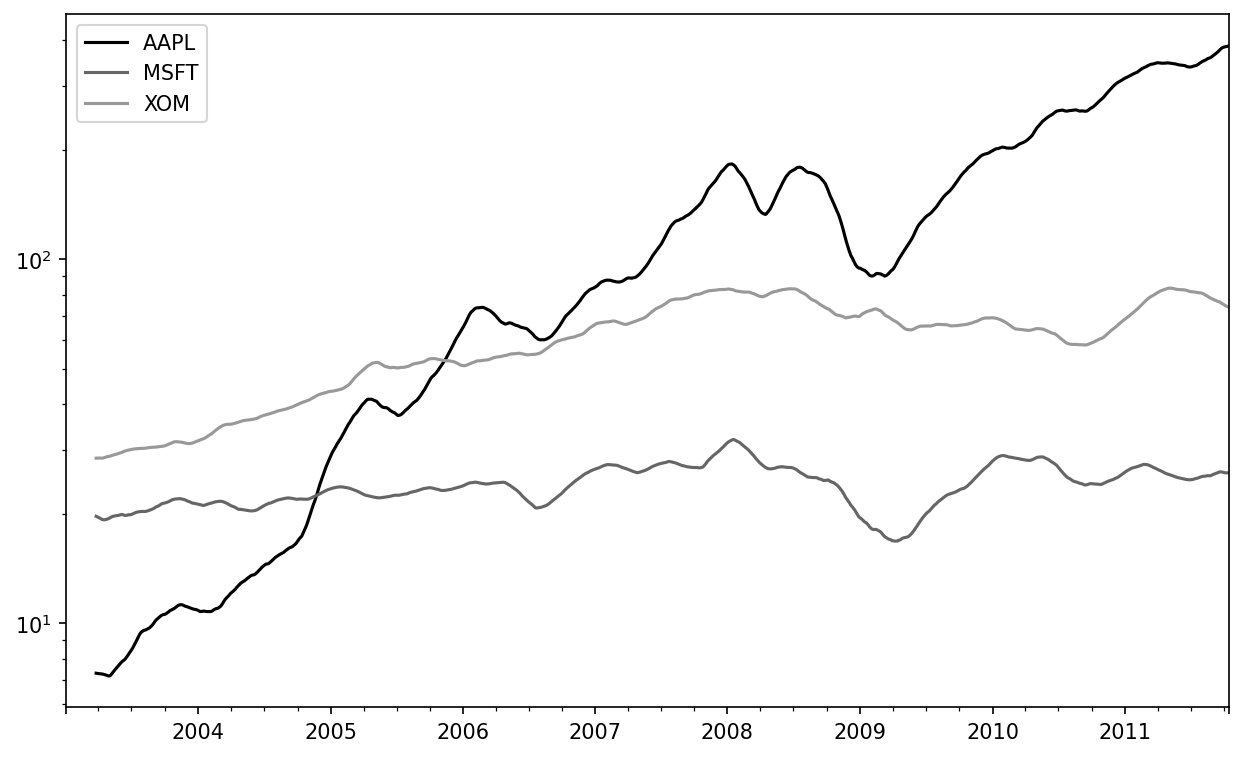

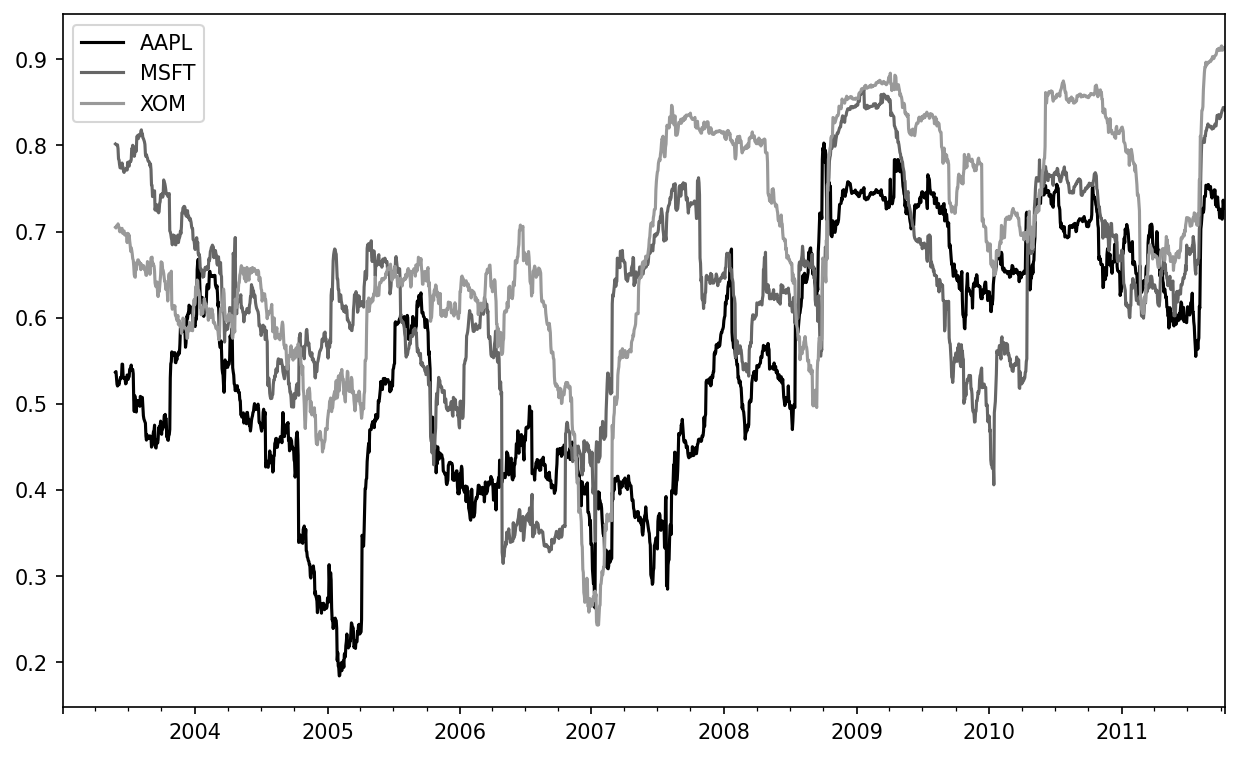

In [259]: expanding_mean = std250.expanding().mean()Calling a moving window function on a DataFrame applies the transformation to each column (see Stock prices 60-day moving average (log y-axis)):

In [261]: plt.style.use('grayscale')

In [262]: close_px.rolling(60).mean().plot(logy=True)The rolling function also accepts a string indicating a fixed-size time offset rolling() in moving window functions rather than a set number of periods. Using this notation can be useful for irregular time series. These are the same strings that you can pass to resample. For example, we could compute a 20-day rolling mean like so:

In [263]: close_px.rolling("20D").mean()

Out[263]:

AAPL MSFT XOM

2003-01-02 7.400000 21.110000 29.220000

2003-01-03 7.425000 21.125000 29.230000

2003-01-06 7.433333 21.256667 29.473333

2003-01-07 7.432500 21.425000 29.342500

2003-01-08 7.402000 21.402000 29.240000

... ... ... ...

2011-10-10 389.351429 25.602143 72.527857

2011-10-11 388.505000 25.674286 72.835000

2011-10-12 388.531429 25.810000 73.400714

2011-10-13 388.826429 25.961429 73.905000

2011-10-14 391.038000 26.048667 74.185333

[2292 rows x 3 columns]Exponentially Weighted Functions

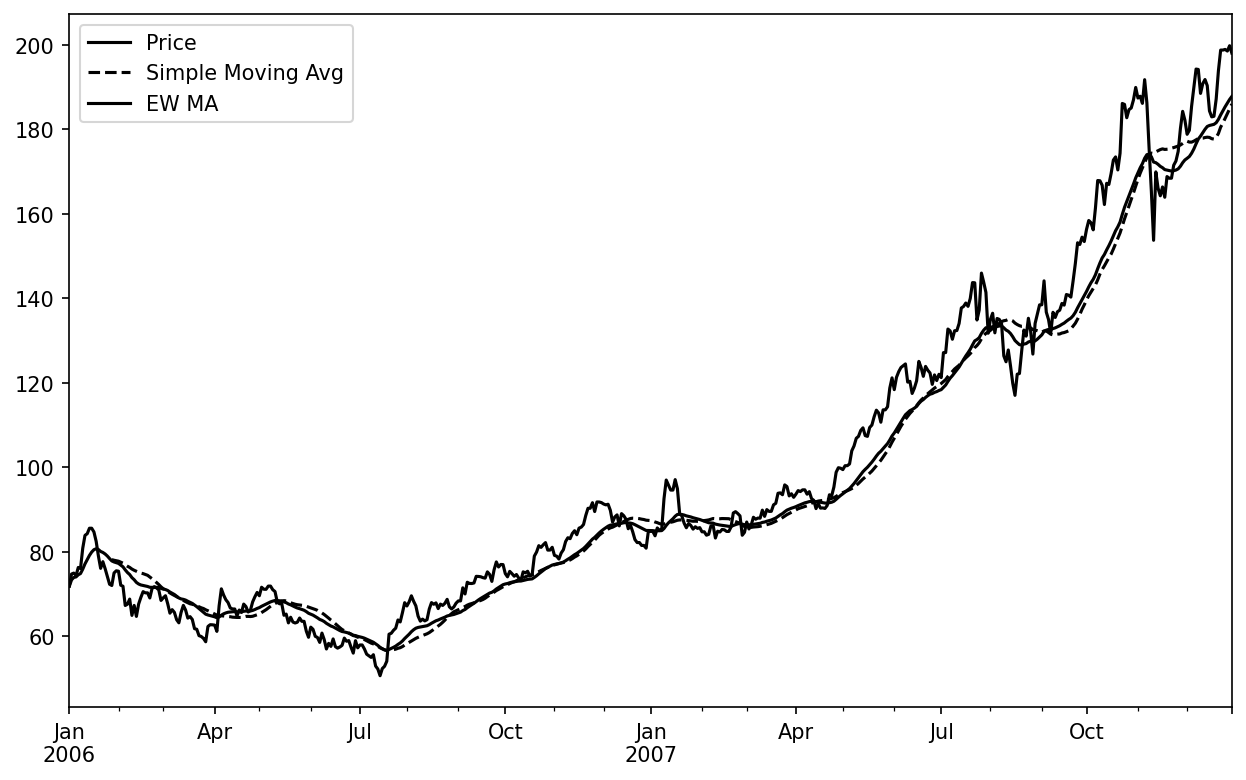

An alternative to using a fixed window size with equally weighted observations is to specify a constant decay factor to give more weight to more recent observations. There are a couple of ways to specify the decay factor. A popular one is using a span, which makes the result comparable to a simple moving window function with window size equal to the span.

Since an exponentially weighted statistic places more weight on more recent observations, it “adapts” faster to changes compared with the equal-weighted version.

pandas has the ewm operator (which stands for exponentially weighted moving) to go along with rolling and expanding. Here’s an example comparing a 30-day moving average of Apple’s stock price with an exponentially weighted (EW) moving average with span=60 (see Simple moving average versus exponentially weighted):

In [265]: aapl_px = close_px["AAPL"]["2006":"2007"]

In [266]: ma30 = aapl_px.rolling(30, min_periods=20).mean()

In [267]: ewma30 = aapl_px.ewm(span=30).mean()

In [268]: aapl_px.plot(style="k-", label="Price")

Out[268]: <Axes: >

In [269]: ma30.plot(style="k--", label="Simple Moving Avg")

Out[269]: <Axes: >

In [270]: ewma30.plot(style="k-", label="EW MA")

Out[270]: <Axes: >

In [271]: plt.legend()Binary Moving Window Functions

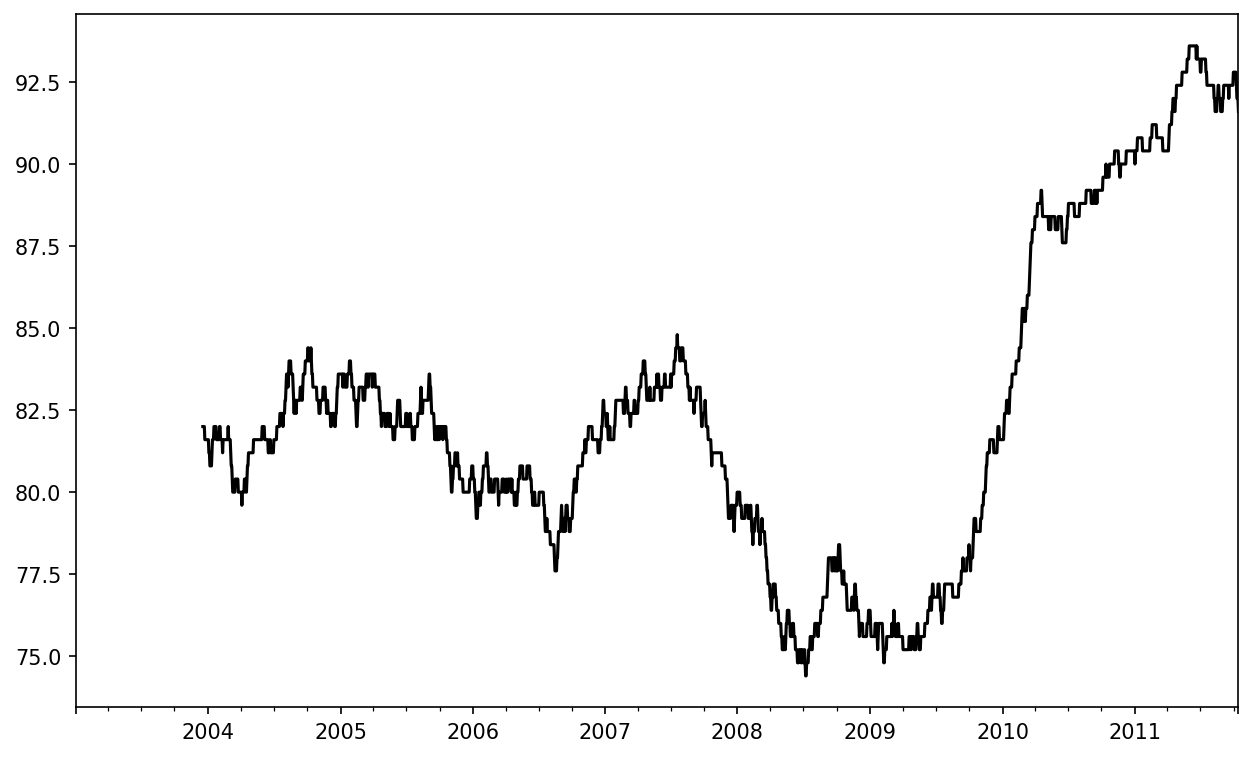

Some statistical operators, like correlation and covariance, need to operate on two time series. As an example, financial analysts are often interested in a stock’s correlation to a benchmark index like the S&P 500. To have a look at this, we first compute the percent change for all of our time series of interest:

In [273]: spx_px = close_px_all["SPX"]

In [274]: spx_rets = spx_px.pct_change()

In [275]: returns = close_px.pct_change()After we call rolling, the corr aggregation function can then compute the rolling correlation with spx_rets (see Six-month AAPL return correlation to S&P 500 for the resulting plot):

In [276]: corr = returns["AAPL"].rolling(125, min_periods=100).corr(spx_rets)

In [277]: corr.plot()Suppose you wanted to compute the rolling correlation of the S&P 500 index with many stocks at once. You could write a loop computing this for each stock like we did for Apple above, but if each stock is a column in a single DataFrame, we can compute all of the rolling correlations in one shot by calling rolling on the DataFrame and passing the spx_rets Series.

See Six-month return correlations to S&P 500 for the plot of the result:

In [279]: corr = returns.rolling(125, min_periods=100).corr(spx_rets)

In [280]: corr.plot()User-Defined Moving Window Functions

The apply method on rolling and related methods provides a way to apply an array function of your own creation over a moving window. The only requirement is that the function produce a single value (a reduction) from each piece of the array. For example, while we can compute sample quantiles using rolling(...).quantile(q), we might be interested in the percentile rank of a particular value over the sample. The scipy.stats.percentileofscore function does just this (see Percentile rank of 2% AAPL return over one-year window for the resulting plot):

In [282]: from scipy.stats import percentileofscore

In [283]: def score_at_2percent(x):

.....: return percentileofscore(x, 0.02)

In [284]: result = returns["AAPL"].rolling(250).apply(score_at_2percent)

In [285]: result.plot()If you don't have SciPy installed already, you can install it with conda or pip:

conda install scipy11.8 Conclusion

Time series data calls for different types of analysis and data transformation tools than the other types of data we have explored in previous chapters.

In the following chapter, we will show how to start using modeling libraries like statsmodels and scikit-learn.

The choice of the default values for

closedandlabelmight seem a bit odd to some users. The default isclosed="left"for all but a specific set ("M","A","Q","BM","BQ", and"W") for which the default isclosed="right". The defaults were chosen to make the results more intuitive, but it is worth knowing that the default is not always one or the other.↩︎